Debt Collection Industry Challenges and Trends 2026

Moveo AI Team

22 de janeiro de 2026

in

Percepções da liderança

Comprehensive analysis of debt collection industry statistics and emerging debt collection industry trends — examining how $18 trillion in household debt is reshaping operational strategies for compliance, efficiency, and recovery.

The NY Fed Household Debt and Credit Report documents that total household debt in the US reached $18.04 trillion in Q4 2024, representing an increase of $3.9 trillion since pre-pandemic levels. Quarterly growth was 0.5%, signaling deceleration but persistence at elevated levels.

Simultaneously, the McKinsey Global Institute characterizes the global economy as fundamentally "Out of Balance": for every dollar of new productive investment, the economy generated $1.90 in new debt and $4.00 in new wealth. The structural problem isn't debt volume in isolation, but wealth composition, which came primarily from financial and real estate asset appreciation, not real productivity gains.

As asset appreciation cycles decelerate and interest rates remain normalized, household debt servicing capacity, much of which was leveraged based on inflated net worth, faces structural pressure. This defines the core debt collection industry challenges for 2026.

The debt composition reveals critical vulnerabilities. Mortgage debt ($12.61 trillion) remains the largest component but has stabilized post-2022 rate increases. However, credit card debt crossed $1.21 trillion, the fastest-growing category with a 14.7% annual increase. Auto loan balances reached $1.66 trillion, while student loans stand at $1.62 trillion, with payment resumption creating new delinquency pressures.

The implications for collections operations are profound: institutions must simultaneously manage elevated volumes across multiple product categories, each with distinct risk profiles, regulatory frameworks, and optimal resolution strategies.

The McKinsey Global Payments Report adds a critical layer: payment revenue growth decelerated to approximately 4% globally in 2024 (down from 12% in 2023). Banks and fintechs can no longer mask operational inefficiencies with widened spreads or compensatory volume growth.

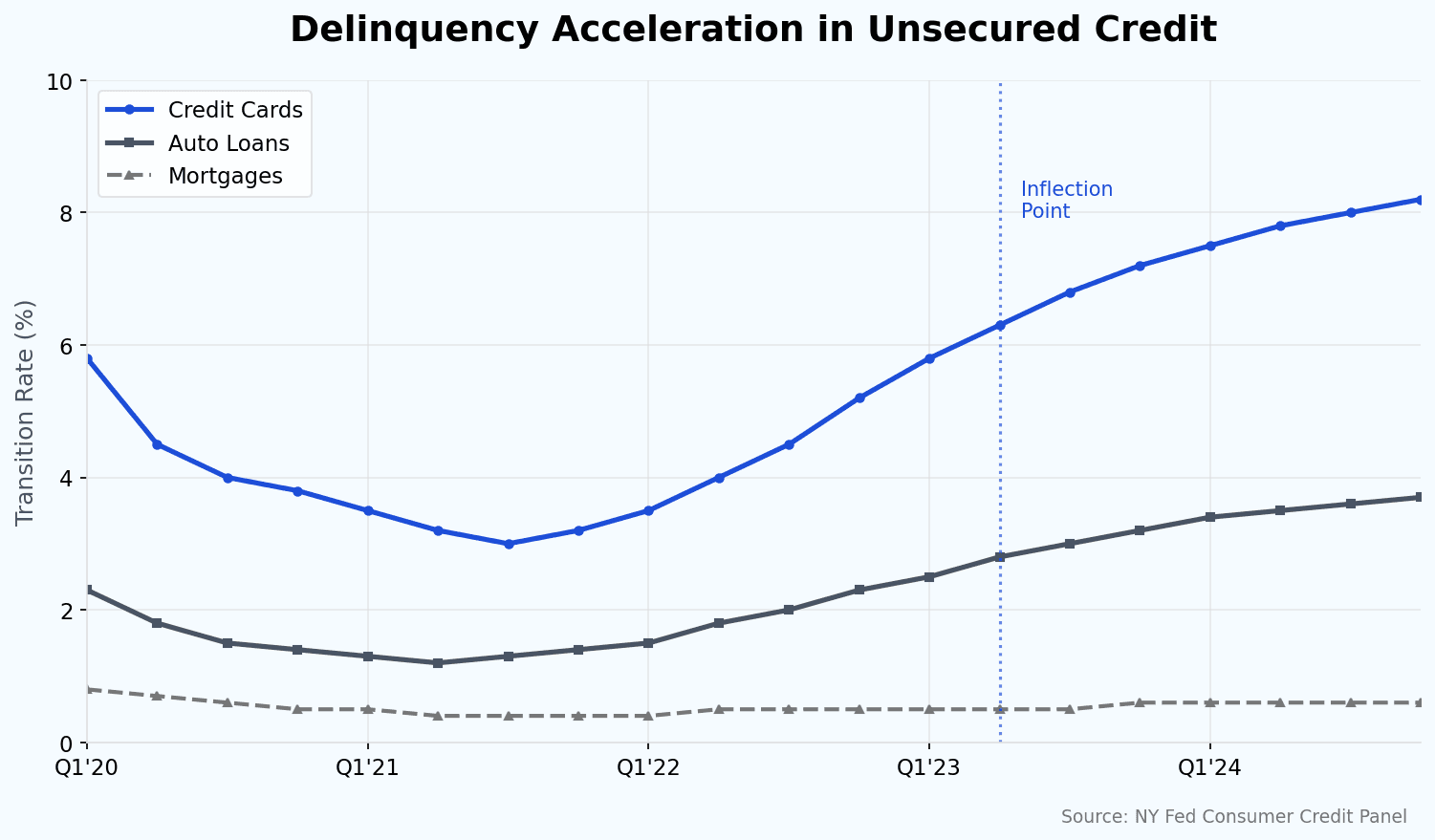

Simultaneously, transition rates to serious delinquency (90+ days) are rising in key categories. NY Fed data shows particularly acute deterioration in credit cards and auto loans: precisely the unsecured credit categories with the highest cost-per-dollar-collected due to low average balances and high contact frequency.

Credit card delinquency transition rates have reached 8.2% (90+ days), the highest level since 2011. Auto loan serious delinquencies hit 3.7%, while mortgage delinquencies remain contained at 0.6%, a divergence that reflects the secured vs. unsecured credit risk differential and the impact of home equity cushions.

Figure 1: Transition Rates to 90+ Day Delinquency by Category | Source: NY Fed Consumer Credit Panel

This combination (growing delinquency volume, compressed margins, and intensified regulatory pressure) creates an operational paradox central to debt collection industry challenges. The traditional response (scaling headcount: adding more collection representatives) collides with three realities:

Rising Operational Costs: In low-unemployment markets, hiring and retaining qualified collections agents has become progressively more expensive. Average agent tenure has declined to under 18 months, creating perpetual training costs and inconsistent service quality.

Elevated Regulatory Risk: The CFPB's annual FDCPA report documents intensified oversight, with complaint volumes nearly doubling year-over-year (from approximately 109,900 in 2023 to 207,800 in 2024).

Declining Effectiveness: As documented in Forbes, massive increases in contact attempts have created saturation that paradoxically reduced consumer response rates.

Learn more → US Delinquency Landscape 2026: Credit Duality and the Role of Agentic AI

The Trust Deficit: Behavioral Data Shaping Industry Trends

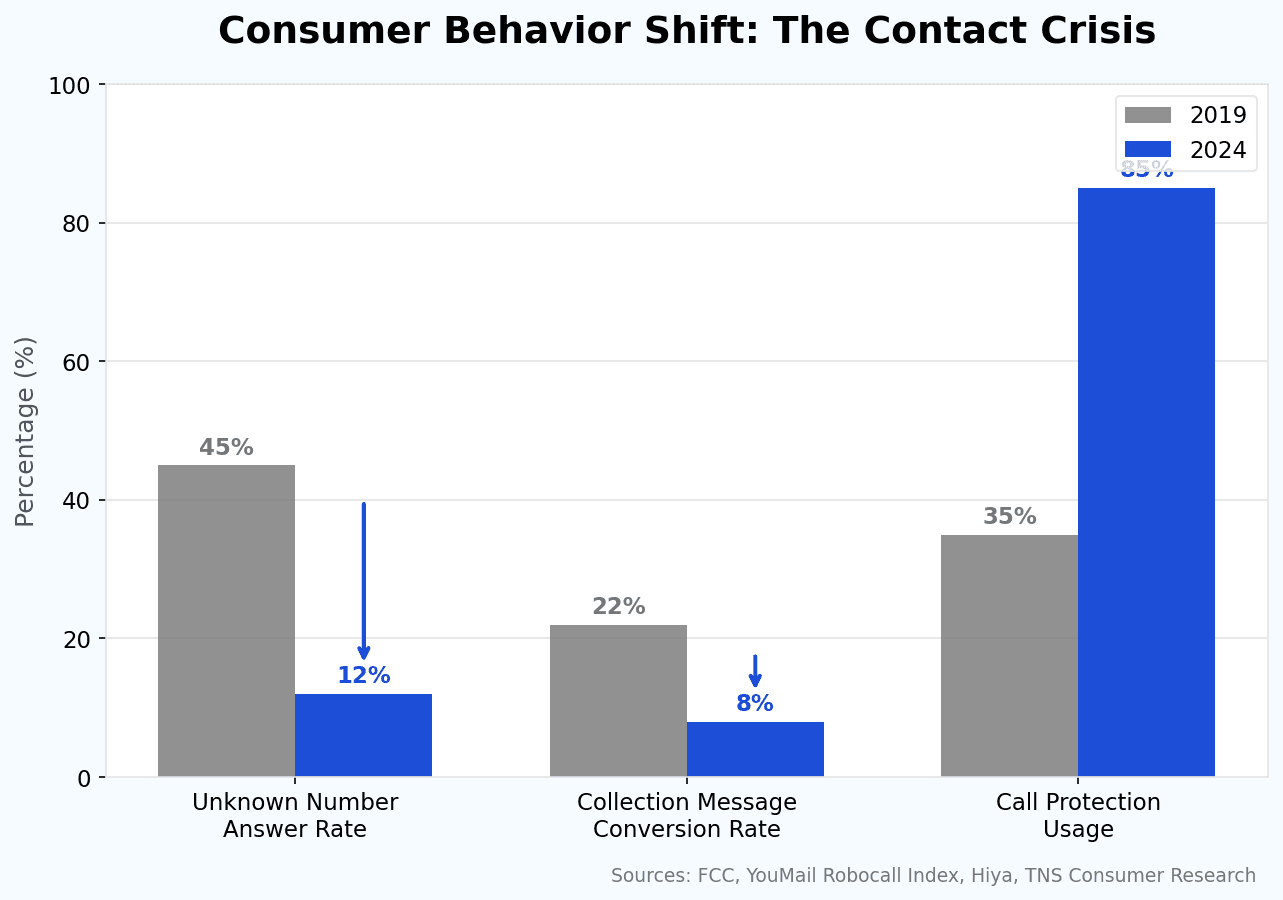

American consumer behavior has fundamentally shifted. The Accenture Life Trends 2025 report documents what it calls the "Digital Trust Deficit", a phenomenon where consumers inundated with spam robocalls (estimated at 50+ billion annually in the US per FCC and YouMail data), SMS fraud attempts, and phishing have developed reflexive protection mechanisms.

The Accenture report specifically identifies the "Cost of Hesitation", consumers increasingly default to ignoring, blocking, or deleting communications from unknown sources rather than risk engagement. This behavioral shift has profound implications for collections operations that historically relied on outbound contact as the primary recovery mechanism.

Data from carriers, call-blocking apps, and industry research indicate that:

Unknown numbers have answer rates below 15% (with some studies showing as low as 8-11%), down from approximately 60% in 2019

75-94% of American consumers either ignore unknown calls entirely or actively use call protection measures, including apps, carrier-level blocking, or permanent Do Not Disturb (per TNS Survey)

Generic collection communications have conversion rates below 10%, with SMS open rates declining despite high delivery rates

Figure 2: The Erosion of Traditional Contact (2019 vs 2024) | Sources: FCC, YouMail, Hiya, TNS Research

Simultaneously, consumer expectations for frictionless digital experiences have increased exponentially. Consumers now expect payment and resolution processes as intuitive as e-commerce checkout. If a debtor wants to negotiate at 2 AM via mobile app but the system forces them to "call during business hours", that recovery opportunity is irreversibly lost.

This expectation gap creates both challenge and opportunity: institutions that meet consumers in their preferred channels and moments capture recoveries that traditional operations systematically miss.

4 Strategic Responses Defining Debt Collection Industry Trends

The McKinsey operational AI trends report indicates that organizations leading in agentic technology adoption achieve results 3.8x superior to market average. For debt collection, this translates into four complementary vectors addressing core debt collection industry challenges:

1. Personalization at Scale: Beyond the FICO Score

Traditional US segmentation relies on delinquency bucketing and FICO scoring. These indicators are necessary for credit risk assessment but insufficient for predicting payment behavior. Two debtors with identical FICO scores and days-past-due may have radically different behavioral profiles; one may be experiencing temporary cash flow constraints but highly motivated to resolve, while the other may be strategically defaulting despite the capacity to pay.

Industry Response

Payment Propensity Score (PPS) modeling that incorporates real-time behavioral data: payment portal login frequency, navigation patterns, historical response to communications, conversational metadata (response time, sentiment in interactions), and external signals, including employment stability indicators and spending pattern changes.

This enables distinction between debtors who:

Cannot pay (genuine financial constraint) → require deep restructuring, hardship programs, extended terms

Won't pay without adequate incentive (engagement problem) → respond to digital nudges, settlement offers, payment plan flexibility

Would pay spontaneously (self-cure profiles) → don't require expensive proactive outreach, just frictionless payment pathways

Operational Impact

According to McKinsey research on AI in collections, organizations deploying advanced AI capabilities can achieve up to 40% reduction in operational expenses and improve recoveries by approximately 10%. Kaplan Group research found that AI-driven predictive scoring models improved recovery rates by an average of 25%. Industry implementations consistently report significant reductions in wasted contact attempts by avoiding outreach to self-cure profiles.

2. Operational Autonomy via AI: Scalable Compliance

Manual negotiation processes don't scale economically. Each customized proposal requires supervisor approval (15-30 minutes), creating latency incompatible with unsecured credit portfolio volumes. Additionally, human agents under pressure may deviate from FDCPA compliance scripts, generating legal exposure.

Industry Response

Autonomous agents with decision authority within rigorously defined guardrails. Systems integrated via API to credit policy engines can:

Verify identity per FDCPA Section 809 (Mini-Miranda requirements)

Evaluate proposals against write-off and refinancing policies in real-time

Calculate the NPV (Net Present Value) of different settlement scenarios

Obtain automated approval via decision engine within policy parameters

Formalize legally binding agreements with proper disclosures

Generate payment instruments (ACH, card-on-file, payment link)

All in under 90 seconds, 24/7, capturing the debtor's moment of willingness regardless of time zone or business hours.

Critical Compliance Differential: An AI agent operating within technical guardrails cannot violate FDCPA rules even under pressure. This dramatically reduces the risk of: calls at prohibited times, communication with unauthorized third parties, threatening or deceptive language, failure to provide mandatory disclosures, and continued contact after cease-and-desist requests.

Practical Example: Debtor proposes paying 30% of the $5,000 balance immediately if the remainder is forgiven. Agent: (1) checks write-off policy (up to 40% permitted for this profile based on DPD, balance, and product), (2) calculates NPV of proposal vs. alternative scenarios (continued collections, charge-off, sale to debt buyer), (3) determines 30% immediate settlement has highest expected value, (4) obtains automated approval, (5) generates formal agreement with required disclosures, (6) processes ACH payment — all in under 90 seconds, at 11:47 PM on a Saturday.

Operational Impact

According to ScienceSoft's AI debt collection analysis, intelligent automation can reduce debtor coverage costs by up to 70% while enabling up to 8x faster operations and delivering 2-4x growth in collector productivity. McKinsey's research documented agent productivity increases of up to 14% with AI copilots, with average handling time reduced by 10% and a 6% increase in recoveries from more successful negotiations.

3. Adaptive Multichannel Orchestration: Maximizing Communication ROI

Effectiveness is no longer a function of an isolated channel. It's a function of an optimized combination of channel, moment, message, and profile. Static cadences ("3 calls + 2 SMS + 1 email in 7 days") ignore individual preferences and waste budget on low-affinity channels for specific profiles.

The variance is substantial: a Gen Z urban consumer may have 0% voice call engagement but 45% RCS/verified SMS engagement. A Boomer in a rural area may show the inverse pattern. Treating both identically guarantees suboptimal outcomes for both and wasted spending.

Industry Response

Orchestration systems based on Reinforcement Learning that continuously analyze each approach's performance and dynamically reallocate resources. The system learns at the individual level which combination of channel × time × message × frequency produces optimal response.

If algorithms detect that:

Urban Millennials convert 42% better via verified SMS/RCS between 7-9 PM, but ignore voice calls entirely

Suburban Gen X responds better to email followed by a phone call between 10 AM-12 PM, with 3x engagement when the email "warms" the subsequent call

Gen Z has a 3x engagement rate via in-app push notification compared to any other channel

...the system automatically adjusts communication budget allocation to maximize ROI per dollar spent. This isn't A/B testing at the segment level: it's continuous optimization at the individual level.

Operational Impact

According to McKinsey, collections operations implementing advanced AI capabilities see up to 30% increase in customer satisfaction scores, driven by the technology's ability to better identify and address customers' needs on time. IBM research indicates chatbots can handle up to 80% of routine inquiries, cutting support costs by approximately 30%. Industry implementations report significant telephony cost reductions by eliminating wasted attempts on non-responsive profiles and improving NPS through preferred-channel engagement.

4. Ecosystem Integration: Breaking Architectural Silos

Many US financial institutions operate with fragmented legacy infrastructure accumulated over decades of acquisitions and system additions:

Dialing systems don't communicate with CRM in real-time

CRM doesn't access credit policies dynamically

Payment portals are separate islands without behavioral data feedback

Interaction data is siloed by department (collections, servicing, fraud)

Result: A debtor may be negotiating simultaneously across three different channels, with each agent lacking visibility into parallel interactions. This generates effort duplication, inconsistent experience (different agents offering different terms), and lost up-sell/cross-sell opportunities. Data latency of 24-48 hours means collections agents work with stale information.

Industry Response

Unified architecture where data, decisions, and actions flow in a closed loop. Three components operate integrated:

Data (predictive segmentation) → Agents (autonomous negotiation) → Optimization (continuous learning) → [feedback loop] → Enriched Data

Each interaction generates new data that refines predictive models, creating a virtuous cycle of continuous improvement.

Operational Impact

McKinsey research shows that end-to-end transformation of collections with gen AI use cases can yield up to 30% productivity gains. A Gartner study projects that AI deployment in debt collection could save $80 billion in labor costs globally by 2026. According to McKinsey, digital customer assistance can reduce non-performing loans by 20-25%. Industry reports indicate that advanced technology implementations have increased debt recoveries by up to 65%. Note: Actual results vary based on portfolio composition, implementation maturity, and market conditions.

Learn more → The Champion Strategy for Debt Collection: AI Trifecta

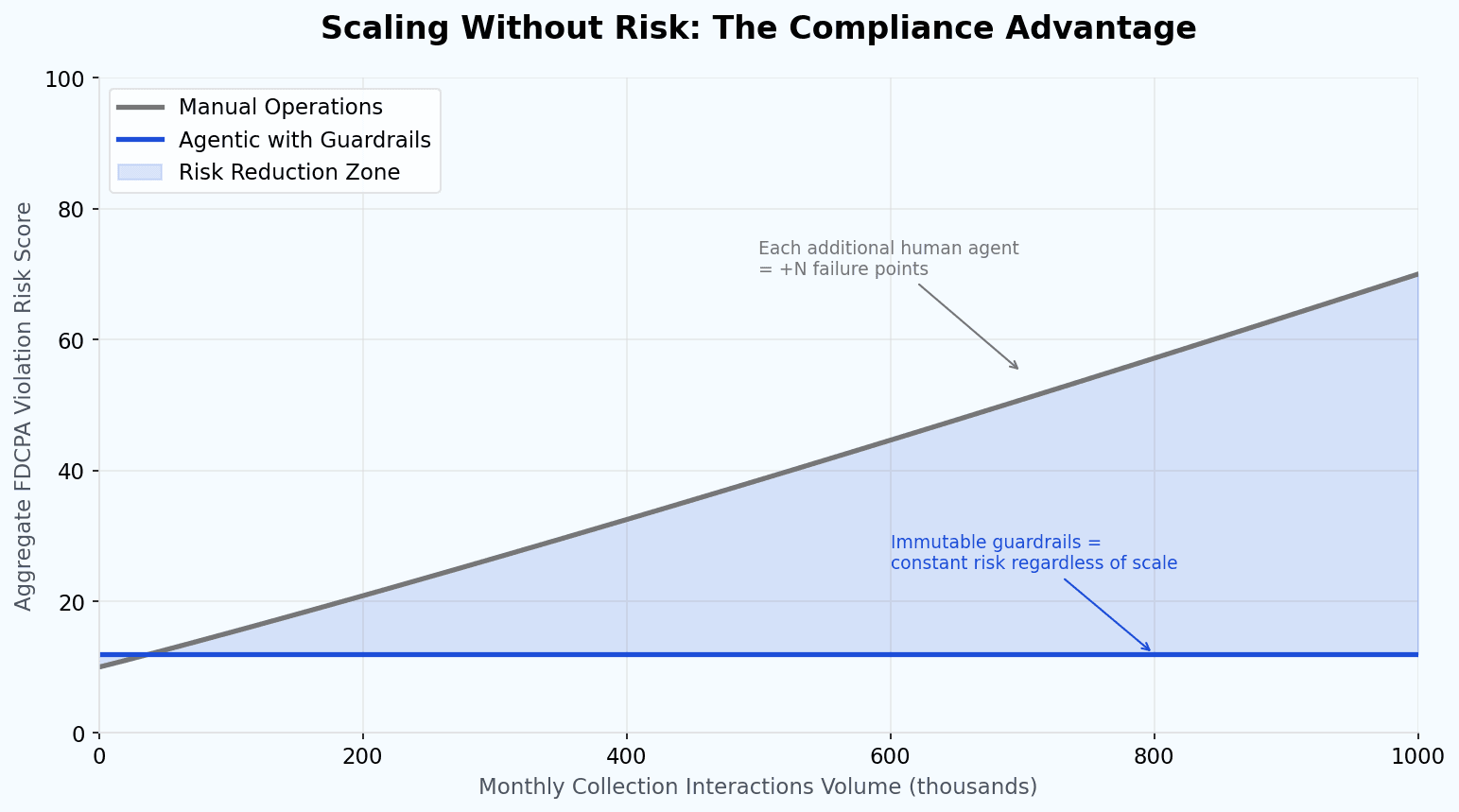

The Compliance Scalability Imperative

An aspect frequently overlooked in collections automation discussions is regulatory risk. The CFPB's annual FDCPA report documents intensified oversight, with complaint volumes nearly doubling year-over-year (from approximately 109,900 in 2023 to 207,800 in 2024).

The advantage of well-implemented autonomous agents isn't just operational efficiency, but compliance by design. When FDCPA rules are encoded in technical guardrails (hard constraints in code, not soft guidelines in training), violation shifts from human possibility to systemic impossibility.

Consider the compliance differential:

Human Agent: Must remember to provide Mini-Miranda disclosure, must track call frequency across systems, must correctly interpret time zone restrictions, and must avoid prohibited language under pressure. Error rate compounds with volume.

Agentic System: Mini-Miranda is hardcoded into every interaction. Call frequency is tracked in real-time with automatic suppression at limits. Time zone verification occurs before any contact attempt. Prohibited language patterns are architecturally impossible.

This inverts the traditional risk equation: instead of scaling operations and multiplying compliance failure points, technology enables scaling while reducing regulatory risk surface.

Figure 3: Compliance Risk vs. Operational Volume — Manual vs. Agentic Operations

From Saturation to Operational Intelligence

The data from NY Fed is unequivocal: $18.04 trillion in household debt, with rising transition rates in unsecured categories. Combined with compressed margins (McKinsey Payments Report) and digital trust deficit (Accenture Life Trends), the scenario demands proportional operational response.

The question isn't whether institutions must transform recovery operations, but when and how. Organizations continuing to scale brute force (more agents, more calls, more SMS) are amplifying costs and risks while facing diminishing returns.

Those implementing the integrated approach (personalization at scale, operational autonomy, adaptive orchestration, unified architecture) report not just cost reduction, but customer satisfaction improvement and documented reduction in CFPB complaints. The technology transformation isn't about replacing human judgment; it's about augmenting human capacity with systems that operate at scale, in real-time, with perfect compliance memory.

The competitive gap between early adopters and laggards is widening. The transformation isn't future, it's underway. These debt collection industry trends will define winners and losers in 2026 and beyond.