US Delinquency Landscape 2026: Credit Duality and the Role of Agentic AI

Moveo AI Team

December 31, 2025

in

📊 Reports

As we project the credit landscape in the United States for 2026, we encounter a "two-speed" economy. While GDP and the labor market suggest a successful Soft Landing following the inflationary cycle, the average consumer's balance sheet tells a different story.

The apparent macroeconomic robustness masks deep fractures within the credit card and auto loan segments.

We are not facing a systemic crisis akin to 2008, but rather a granular and persistent deterioration. The liquidity accumulated during the pandemic has evaporated, and the American consumer has migrated from savings to revolving credit in an environment of historically high interest rates.

For creditors, the challenge in the coming years will not be solely about volume, but operational efficiency: how to recover assets from a polarized debtor base while operating in one of the most expensive labor markets in the world?

The glass half full (or half empty?)

To understand the necessary strategy for 2026, we must dissect the "Glass Half Full" concept highlighted by Reuters. While mortgage delinquency remains controlled, delinquencies in credit cards and auto loans have reached their highest levels in a decade.

TransUnion’s forecast for 2026 suggests that, although volatility may decrease, delinquency rates will remain elevated, pressured by the cost of debt service. The Financial Times reinforces that this stress is not evenly distributed, it is concentrated among subprime borrowers and younger generations (Gen Z and Millennials), who are facing their first real cycle of monetary tightening.

For business strategy, this indicates that the volume-based collection model faces severe limitations. Prime debtors continue to pay, while Subprime borrowers require complex renegotiations that the traditional Call Center model struggles to scale profitably.

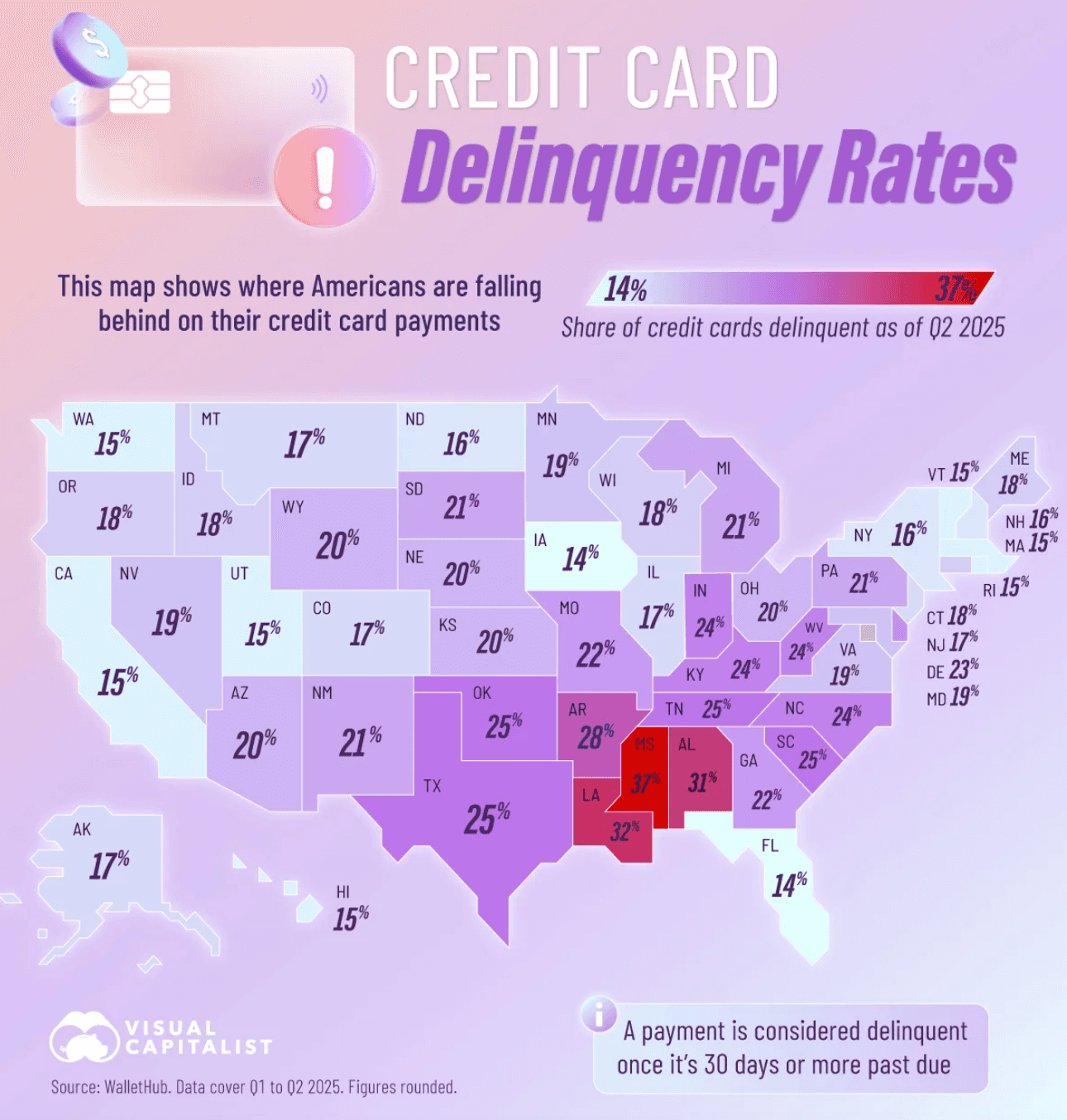

Risk geography and demographic polarization

Treating the US as a monolith is a miscalculation. The risk map outlined by Visual Capitalist reveals critical geographical disparities. Southern states, for example, present delinquency rates significantly higher than the national average, correlated with local income and cost of living.

This polarization demands a dynamic segmentation strategy. A payment delay in California (high cost of living, strong state protections) requires a radically different approach than a delay in Texas. Institutions entering 2026 without the capacity to differentiate these recovery journeys will face rising legal costs and stagnant recovery rates.

Operational cost and regulatory complexity

In the US, the recovery challenge revolves around the intelligent allocation of resources in a landscape of high costs and strict regulation.

In a heated labor market, keeping collection teams focused on repetitive tasks is a waste of intellectual capital. The goal is not to replace humans, but to direct them toward high-complexity cases and sensitive negotiations, leaving transactional volume to automation.

Furthermore, regulation (such as the CFPB’s Reg F) imposes rigid limits on debtor contact. Legal Futures notes that the legal sector is looking to technology as a way to ensure every interaction strictly follows the law, mitigating the risk of class action lawsuits derived from operational errors.

Learn more: AI Agents and Compliance: The Frontier of Enterprise Trust and Reliability

Technological evolution as a path forward

Faced with this scenario of compressed margins and elevated risks, technology is the safest path. It offers the foundation to scale efficiently without compromising compliance or service quality.

1. From Prediction to Autonomous Action (Agentic AI)

The American financial sector has invested heavily in predictive AI (who will owe?). The natural step for 2026 is Agentic AI (how to collect autonomously?).

As detailed by McKinsey, the future belongs to autonomous agents capable of executing end-to-end processes. Imagine an AI agent that not only sends a reminder but negotiates a payment plan via messaging apps or calls, calculates the consumer's financial affordability in real-time, and ensures every word complies with federal and state regulations.

This is not fiction... it is the necessary evolution described in McKinsey’s State of AI report and is already being delivered by advanced solutions like Moveo.AI.

2. Precision and Retention

Fintechs and startups are already leading this revolution, bringing precision to recovery that traditional banks struggle to replicate. Automation via Conversational AI allows debtors to be treated with empathy and personalization at scale, transforming a negative interaction into a long-term retention opportunity.

This approach is fundamental to preserving brand value.

3. Efficiency at Scale

Data from Gitnux and projections from Precedence Research indicate that AI adoption in collections is the primary driver of operational cost reduction projected for the next decade. In a market where every Basis Point (bps) matters, replacing repetitive manual tasks with Agentic Intelligence is the only way to protect the Bottom Line.

Strategic adaptation for a transforming market

The US delinquency landscape for 2026 allows no room for complacency. The economy may have landed softly, but for millions of consumers, financial turbulence persists. The gap between those with liquidity and those relying on revolving credit has widened, creating a minefield for credit issuers.

The era of brute-force collections is over. The future demands intelligence. The institutions that thrive will be those that adopt Agentic AI not merely as an automation tool, but as the strategic core of their recovery operations, ensuring compliance, reducing costs, and, crucially, treating credit recovery as an extension of the customer experience.

At Moveo.AI, we don't just watch this transition to the Agentic era; we lead it. Our AI agents are already operating with the granularity and compliance necessary to navigate complex landscapes.

If your institution seeks to turn credit recovery into a competitive advantage for 2026, talk to one of our experts →