Cobranças Humanizadas

Cobranças Humanizadas

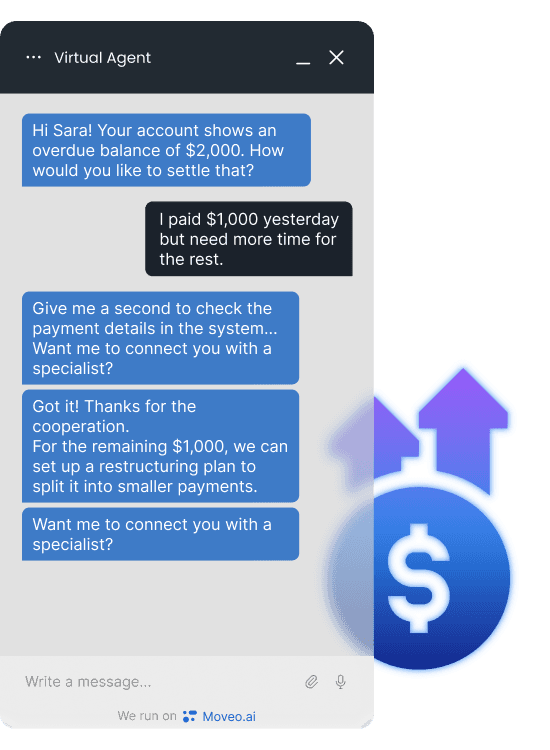

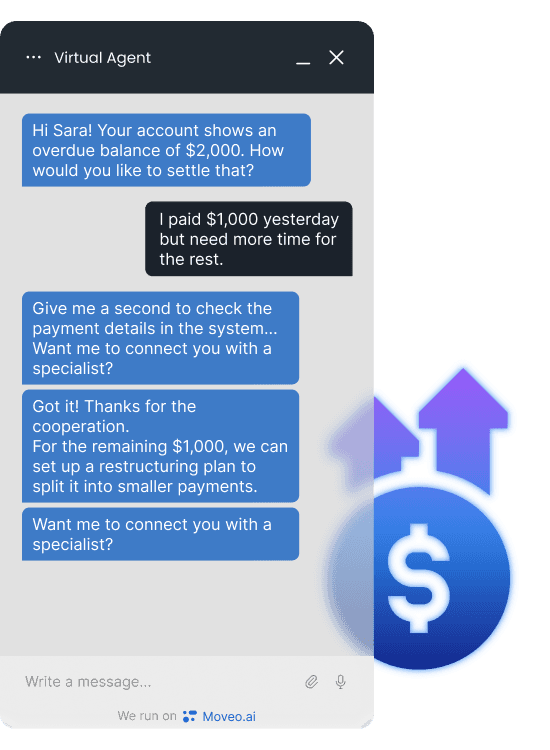

Transforme inadimplências em pagamentos pontuais com agentes inteligentes orientados por metas, que transformam "Eu esqueci" em "Pago hoje".

Transforme inadimplências em pagamentos pontuais com agentes inteligentes orientados por metas, que transformam "Eu esqueci" em "Pago hoje".

Utilidades em Alta

Agências de Cobranças

Banking e Serviços Financeiros

Prestadora de serviços públicos

Compre agora e Pague depois (BNPL)

Seguradoras

Setor de saúde

Ligações perdidas = Dinheiro perdido

Ligações perdidas = Dinheiro perdido

Métodos de cobrança tradicionais. como ligações e emails, dependem de um processo manual absoleto, demorado e não escalável

2-3%

taxa de sucesso de ligações

90%

de ligações recebidas por números anônimos não são atendidas

15

ligações necessárias antes do inadimplente atender

Colete dívidas de forma mais inteligente com Agentes Inteligentes de IA

O LLM privado da Moveo é treinado em conversas relacionadas a negócios e supera o GPT-4 se tratando de CX. Integre ao seu conjunto de softwares para executar tarefas enquanto mantém seus dados empresariais seguros e confidenciais.

LMMs próprios com foco em CX

Utilize em diversos canais

NLP de excelência

Integrações completas com seus softwares

O LLM privado da Moveo é treinado em conversas relacionadas a negócios e supera o GPT-4 se tratando de CX. Integre ao seu conjunto de softwares para executar tarefas enquanto mantém seus dados empresariais seguros e confidenciais.

LMMs próprios com foco em CX

Utilize em diversos canais

NLP de excelência

Integrações completas com seus softwares

O LLM privado da Moveo é treinado em conversas relacionadas a negócios e supera o GPT-4 se tratando de CX. Integre ao seu conjunto de softwares para executar tarefas enquanto mantém seus dados empresariais seguros e confidenciais.

LMMs próprios com foco em CX

Utilize em diversos canais

NLP de excelência

Integrações completas com seus softwares

Confiada por empresas líderes de mercado

Uma história real de Sucesso: Agentes de IA da Moveo em ação

Uma história real de Sucesso: Agentes de IA proativos da Moveo em ação

2x

Melhorias nas Cobranças VS

Chatbots tradicionais

98%

Eficácia em entender o que os clientes querem dizer

Transformando Cobranças com o Broadcast: Caso de Uso de Sucesso

Descubra como a Mobi2buy melhorou a cobrança de dívidas de uma das maiores

empresas de telecomunicações da América Latina. Ao utilizar abordagens proativas e conversas impulsionadas por IA, eles alcançam 200 mil usuários por mês, com 51 mil deles pagando suas dívidas.

'Como CEO da mobi2buy, tenho o prazer de destacar a importância de nossa parceria com a Moveo na promoção de inovações no mercado brasileiro. Nossas soluções de IA nos permitem ser mais competitivos e atender às crescentes necessidades das empresas brasileiras."

Thiago Taranto, CEO

'Como CEO da mobi2buy, tenho o prazer de destacar a importância de nossa parceria com a Moveo na promoção de inovações no mercado brasileiro. Nossas soluções de IA nos permitem ser mais competitivos e atender às crescentes necessidades das empresas brasileiras."

Thiago Taranto, CEO

'Como CEO da mobi2buy, tenho o prazer de destacar a importância de nossa parceria com a Moveo na promoção de inovações no mercado brasileiro. Nossas soluções de IA nos permitem ser mais competitivos e atender às crescentes necessidades das empresas brasileiras."

Thiago Taranto, CEO

Pronto para elevar a sua estratégia de Cobrança?

Agende uma demonstração hoje e deixe-nos mostrar como nossa solução de IA pode transformar suas cobranças de "Ignoradas" para "Pagas"

FAQs

What is an AI collection agent?

An AI collection agent is a conversational AI that automates the debt recovery process through chat, SMS, email or voice. It engages with customers in natural language, negotiates payments, and ensures compliance all without human intervention using context-aware and customer information to maximize revenue recovery

What is an AI collection agent?

An AI collection agent is a conversational AI that automates the debt recovery process through chat, SMS, email or voice. It engages with customers in natural language, negotiates payments, and ensures compliance all without human intervention using context-aware and customer information to maximize revenue recovery

What is an AI collection agent?

An AI collection agent is a conversational AI that automates the debt recovery process through chat, SMS, email or voice. It engages with customers in natural language, negotiates payments, and ensures compliance all without human intervention using context-aware and customer information to maximize revenue recovery

What is an AI collection agent?

An AI collection agent is a conversational AI that automates the debt recovery process through chat, SMS, email or voice. It engages with customers in natural language, negotiates payments, and ensures compliance all without human intervention using context-aware and customer information to maximize revenue recovery

How does AI debt collection work for utility companies?

AI collection agents integrate with utility billing systems to engage past-due customers via text or voice, negotiate payment plans, and resolve balances instantly 24/7. This reduces call center volume and improves customer satisfaction.

How does AI debt collection work for utility companies?

AI collection agents integrate with utility billing systems to engage past-due customers via text or voice, negotiate payment plans, and resolve balances instantly 24/7. This reduces call center volume and improves customer satisfaction.

How does AI debt collection work for utility companies?

AI collection agents integrate with utility billing systems to engage past-due customers via text or voice, negotiate payment plans, and resolve balances instantly 24/7. This reduces call center volume and improves customer satisfaction.

How does AI debt collection work for utility companies?

AI collection agents integrate with utility billing systems to engage past-due customers via text or voice, negotiate payment plans, and resolve balances instantly 24/7. This reduces call center volume and improves customer satisfaction.

Is AI debt collection compliant with industry regulations?

Yes. Moveo.AI Collection Agents Platform has built-in compliance framework and is designed to follow FDCPA, TCPA, GDPR, Hippa, and regional regulatory frameworks. Conversations are auditable, and automatically adapt to contact preferences and consent requirements. Not only that, Moveo.AI agent-as-a-service platform can be deployed in private cloud or premise ensuring compliance and privacy.

Is AI debt collection compliant with industry regulations?

Yes. Moveo.AI Collection Agents Platform has built-in compliance framework and is designed to follow FDCPA, TCPA, GDPR, Hippa, and regional regulatory frameworks. Conversations are auditable, and automatically adapt to contact preferences and consent requirements. Not only that, Moveo.AI agent-as-a-service platform can be deployed in private cloud or premise ensuring compliance and privacy.

Is AI debt collection compliant with industry regulations?

Yes. Moveo.AI Collection Agents Platform has built-in compliance framework and is designed to follow FDCPA, TCPA, GDPR, Hippa, and regional regulatory frameworks. Conversations are auditable, and automatically adapt to contact preferences and consent requirements. Not only that, Moveo.AI agent-as-a-service platform can be deployed in private cloud or premise ensuring compliance and privacy.

Is AI debt collection compliant with industry regulations?

Yes. Moveo.AI Collection Agents Platform has built-in compliance framework and is designed to follow FDCPA, TCPA, GDPR, Hippa, and regional regulatory frameworks. Conversations are auditable, and automatically adapt to contact preferences and consent requirements. Not only that, Moveo.AI agent-as-a-service platform can be deployed in private cloud or premise ensuring compliance and privacy.

Can AI agents handle healthcare and medical debt collections?

AI agents are ideal for hospital billing departments, medical debt recovery, and RCM providers, offering gentle, compliant patient billing engagement that improves revenue cycle management and reduces administrative costs.

Can AI agents handle healthcare and medical debt collections?

AI agents are ideal for hospital billing departments, medical debt recovery, and RCM providers, offering gentle, compliant patient billing engagement that improves revenue cycle management and reduces administrative costs.

Can AI agents handle healthcare and medical debt collections?

AI agents are ideal for hospital billing departments, medical debt recovery, and RCM providers, offering gentle, compliant patient billing engagement that improves revenue cycle management and reduces administrative costs.

Can AI agents handle healthcare and medical debt collections?

AI agents are ideal for hospital billing departments, medical debt recovery, and RCM providers, offering gentle, compliant patient billing engagement that improves revenue cycle management and reduces administrative costs.

How does AI support BNPL collections or short-term lending?

For BNPL and fintech lenders, AI agents engage borrowers proactively across mobile-first channels (e.g., WhatsApp, SMS, email), offer instant repayment options, and escalate only high-risk cases to humans.

How does AI support BNPL collections or short-term lending?

For BNPL and fintech lenders, AI agents engage borrowers proactively across mobile-first channels (e.g., WhatsApp, SMS, email), offer instant repayment options, and escalate only high-risk cases to humans.

How does AI support BNPL collections or short-term lending?

For BNPL and fintech lenders, AI agents engage borrowers proactively across mobile-first channels (e.g., WhatsApp, SMS, email), offer instant repayment options, and escalate only high-risk cases to humans.

How does AI support BNPL collections or short-term lending?

For BNPL and fintech lenders, AI agents engage borrowers proactively across mobile-first channels (e.g., WhatsApp, SMS, email), offer instant repayment options, and escalate only high-risk cases to humans.

What is the average cost to collect using an AI agent?

AI agents cost around $1 per resolved case, compared to $5–$10 per manual agent call. That’s up to 75% savings in operational costs and up to 16× ROI, depending on your industry and average recovery size.

What is the average cost to collect using an AI agent?

AI agents cost around $1 per resolved case, compared to $5–$10 per manual agent call. That’s up to 75% savings in operational costs and up to 16× ROI, depending on your industry and average recovery size.

What is the average cost to collect using an AI agent?

AI agents cost around $1 per resolved case, compared to $5–$10 per manual agent call. That’s up to 75% savings in operational costs and up to 16× ROI, depending on your industry and average recovery size.

What is the average cost to collect using an AI agent?

AI agents cost around $1 per resolved case, compared to $5–$10 per manual agent call. That’s up to 75% savings in operational costs and up to 16× ROI, depending on your industry and average recovery size.

Can AI handle both early-stage and late-stage collections?

AI agents can adapt their tone and strategy depending on the stage of delinquency, offering softer reminders for early-stage debt, and firmer but compliant engagement for charge-offs or recoveries.

Can AI handle both early-stage and late-stage collections?

AI agents can adapt their tone and strategy depending on the stage of delinquency, offering softer reminders for early-stage debt, and firmer but compliant engagement for charge-offs or recoveries.

Can AI handle both early-stage and late-stage collections?

AI agents can adapt their tone and strategy depending on the stage of delinquency, offering softer reminders for early-stage debt, and firmer but compliant engagement for charge-offs or recoveries.

Can AI handle both early-stage and late-stage collections?

AI agents can adapt their tone and strategy depending on the stage of delinquency, offering softer reminders for early-stage debt, and firmer but compliant engagement for charge-offs or recoveries.

Do AI debt collection chatbots work for student loan or education-related debt?

AI debt collection and loan chatbots are highly effective for managing student loan repayments, tuition arrears, and education financing plans. They engage borrowers across SMS, email, or webchat to offer reminders, payment plans, and instant settlement without the friction of manual outreach. This makes them ideal for universities, student loan servicers, and education fintech platforms looking to reduce delinquencies while preserving goodwill.

Do AI debt collection chatbots work for student loan or education-related debt?

AI debt collection and loan chatbots are highly effective for managing student loan repayments, tuition arrears, and education financing plans. They engage borrowers across SMS, email, or webchat to offer reminders, payment plans, and instant settlement without the friction of manual outreach. This makes them ideal for universities, student loan servicers, and education fintech platforms looking to reduce delinquencies while preserving goodwill.

Do AI debt collection chatbots work for student loan or education-related debt?

AI debt collection and loan chatbots are highly effective for managing student loan repayments, tuition arrears, and education financing plans. They engage borrowers across SMS, email, or webchat to offer reminders, payment plans, and instant settlement without the friction of manual outreach. This makes them ideal for universities, student loan servicers, and education fintech platforms looking to reduce delinquencies while preserving goodwill.

Do AI debt collection chatbots work for student loan or education-related debt?

AI debt collection and loan chatbots are highly effective for managing student loan repayments, tuition arrears, and education financing plans. They engage borrowers across SMS, email, or webchat to offer reminders, payment plans, and instant settlement without the friction of manual outreach. This makes them ideal for universities, student loan servicers, and education fintech platforms looking to reduce delinquencies while preserving goodwill.

Can AI collection agents detect and handle disputed debts?

Modern AI collection agents are equipped with intent recognition and escalation logic that can detect phrases indicating a dispute, objection, or misunderstanding. When such a case arises, the AI either responds with compliant information or seamlessly transfers the conversation to a live agent with full context. This ensures a smooth, compliant experience — especially in regulated sectors like healthcare, telecom, or financial services.

Can AI collection agents detect and handle disputed debts?

Modern AI collection agents are equipped with intent recognition and escalation logic that can detect phrases indicating a dispute, objection, or misunderstanding. When such a case arises, the AI either responds with compliant information or seamlessly transfers the conversation to a live agent with full context. This ensures a smooth, compliant experience — especially in regulated sectors like healthcare, telecom, or financial services.

Can AI collection agents detect and handle disputed debts?

Modern AI collection agents are equipped with intent recognition and escalation logic that can detect phrases indicating a dispute, objection, or misunderstanding. When such a case arises, the AI either responds with compliant information or seamlessly transfers the conversation to a live agent with full context. This ensures a smooth, compliant experience — especially in regulated sectors like healthcare, telecom, or financial services.

Can AI collection agents detect and handle disputed debts?

Modern AI collection agents are equipped with intent recognition and escalation logic that can detect phrases indicating a dispute, objection, or misunderstanding. When such a case arises, the AI either responds with compliant information or seamlessly transfers the conversation to a live agent with full context. This ensures a smooth, compliant experience — especially in regulated sectors like healthcare, telecom, or financial services.

Plataforma

Plataforma

Recursos

Solutions

Contato

info@moveo.ai

368 9th Ave.

New York, NY

10001, USA

Avenida Paulista, 1374

Bela Vista, São Paulo

SP 01310-100, Brazil

Makedonon 8

Athens, Attiki

11521, Greece

Moveo.AI © 2025 | All rights reserved.

Plataforma

Plataforma

Recursos

Solutions

Contato

info@moveo.ai

368 9th Ave.

New York, NY

10001, USA

Avenida Paulista, 1374

Bela Vista, São Paulo

SP 01310-100, Brazil

Makedonon 8

Athens, Attiki

11521, Greece

Moveo.AI © 2025 | All rights reserved.

Plataforma

Plataforma

Contato

Makedonon 8

Athens, Attiki

11521, Greece

368 9th Ave.

New York, NY

10001, USA

info@moveo.ai

Avenida Paulista, 1374

Bela Vista, São Paulo

SP 01310-100, Brazil

Moveo.AI © 2025 | All rights reserved.

Plataforma

Plataforma

Contato

info@moveo.ai

368 9th Ave.

New York, NY

10001, USA

Avenida Paulista, 1374

Bela Vista, São Paulo

SP 01310-100, Brazil

Makedonon 8

Athens, Attiki

11521, Greece

Moveo.AI © 2025 | All rights reserved.