Customer service is a cornerstone of modern banking experiences. People expect fast, always-on support for money matters and often bring complex, high-stakes inquiries to support teams for resolution. A strong framework is needed to deliver the customer experiences people expect from modern banks and reduce staff burnout and churn.

Generative AI (GenAI) banking chatbots have emerged as a powerful tool for banks to streamline customer service while augmenting their team’s capabilities and scale. According to the McKinsey Global Institute, generative AI is predicted to generate $200 billion to $340 billion of the banking industry’s annual revenue.

As the banking industry undergoes massive digital transformation, those looking to stay competitive in this new era must prioritize an innovative CX strategy. Worrying conversations around data privacy and security with AI have resulted in some reticence from financial stakeholders. Additionally, the risk of algorithms “hallucinating” financial information — or misrepresenting financial insights on highly consequential topics, like corporate reporting — remains a top concern for many in the banking sector.

💡 Read: Companies that banned ChatGPT

Fortunately, innovations in generative AI have paved the path for applications where enterprises can harness the value of GenAI agents, while still maintaining data security and consumer privacy. Read on for a deep dive into the unique opportunity chatbots offer the high-stakes banking industry and how to identify the right GenAI agent for your needs.

Using Generative AI to Optimize your CX Strategy

Banking customer service involves a range of sensitive and complex inquiries—deposits, loan applications, credit card activations, account updates, and more. You can leverage AI agents to facilitate these tasks, benefiting both the customer and the employee experience.

Empower Customers with Self-Service Options and Reduce Wait Times

Customers face many challenges with traditional chatbots and contact center automation — dial menus with robotic answers, repetitive and frustrating fallbacks, and long wait lines. Additionally, clunky technology that fails to integrate with a company’s tech stack leads to impersonal responses and a lack of dynamic, current information.

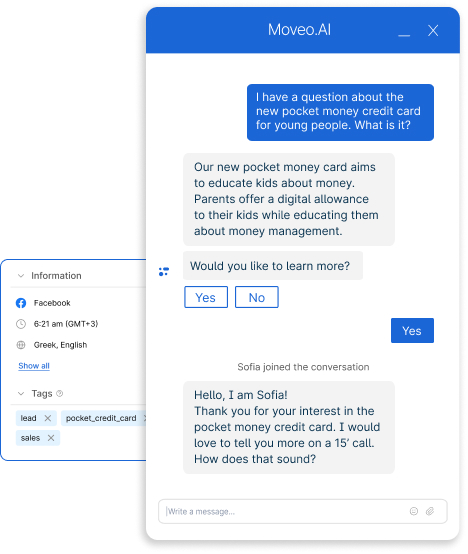

In recent years, GenAI agents have empowered banks to raise the bar on their contact center automation to deliver a more cohesive customer journey. Effective GenAI agents will deliver sophisticated conversational experiences that understand the nuances of human language and provide the accurate answers that customers seek. Advanced GenAI agents can even automate complex banking processes, like loan applications and transaction statuses, by seamlessly integrating with a company’s tech stack. This significantly increases the speed at which banks can address customer needs and, at the same time, removes the onus of mundane, repetitive tasks from live agents.

Allowing customers to address their inquiries or achieve their goals without waiting in line for a live agent can significantly improve customer satisfaction and loyalty. Check out our case study with Viva to understand how effective GenAI agents enhance customer experiences and deliver measurable outcomes for businesses.

Deliver More Personalized Experiences in a Privacy-Compliant Way

Personalization is table stakes in customer experience today. Generative AI has offered significant strides in the level of personalized interactions banks can deliver to their customers today. Rather than leaning on generic messaging, AI-powered chatbots can read specific customer inputs and deliver custom, conversational responses based on the customer’s unique circumstances.

This level of personalization can go a long way in building brand loyalty and trust. Consumers who feel heard and recognized by a brand are more likely to return. Especially in an industry where people may come to customer service stressed out or frustrated, empathetic or understanding service can provide the comfort they need to feel satisfied.

Of course, leveraging customer data to deliver personalized experiences requires respect for consumer privacy as well. A good GenAI agent will have a framework in place to ensure that information remains confidential and that consent is built into the practice. This can include back-end integration, redaction tools, or other tactics such as on-premise installation.

Check out this article for a deeper dive into how conversational AI in banking strengthens security.

Enable Banking Staff to Deliver More Impactful One-on-One Support

While chatbots offer a range of direct benefits to customers, effective GenAI agents will also help banking staff do their jobs better. We’ve already covered how self-service options can eliminate routine tasks for staff, freeing them up to focus on inquiries that require more complex knowledge and attention.

In addition to creating a more enjoyable and manageable workload for staff, GenAI agents can empower live agents with insights they wouldn’t otherwise have easy access to, like historical bank transactions, buying intent, and churn prediction. Predictive analytics can also help surface insights tools or resources that customers may seek based on their inquiries. These offerings can pay dividends for new hires, bringing employees up to speed faster than was previously possible.

Together, these AI augmentations help banking employees do their jobs better and more efficiently so they can deliver better experiences for customers. It’s a win-win enhancement across the customer service ecosystem.

Find the Right Partner for Implementing Your GenAI Agent

Implementing a generative AI chatbot in banking is a high-risk, high reward. The benefits are clear, but it’s critical that financial institutions find the right partner to fully take advantage of them. Otherwise, they risk alienating customers rather than engaging them. Here’s what you should look for when identifying a partner to help you raise the bar on your CX strategy.

- Vertical Experience

While AI has taken over just about every industry, applications and nuances are unique to each vertical. Find a partner who has expertise in your space so that they can help you navigate the opportunities and challenges you’re likely to face as you embark on this journey. - Flexibility & Customization

It’s imperative that you find a partner that can deliver customized solutions for you and your business. In banking, for example, it’s imperative to ensure safe and compliant interactions across the customer journey. Regulations can also differ across organizations, so one-on-one customization is key. - End-to-End Support

As the customer journey becomes increasingly fragmented, you need a partner who can integrate various touch points, from onboarding to account closure. The ability to automate procedures without third-party connections is a clear differentiator.

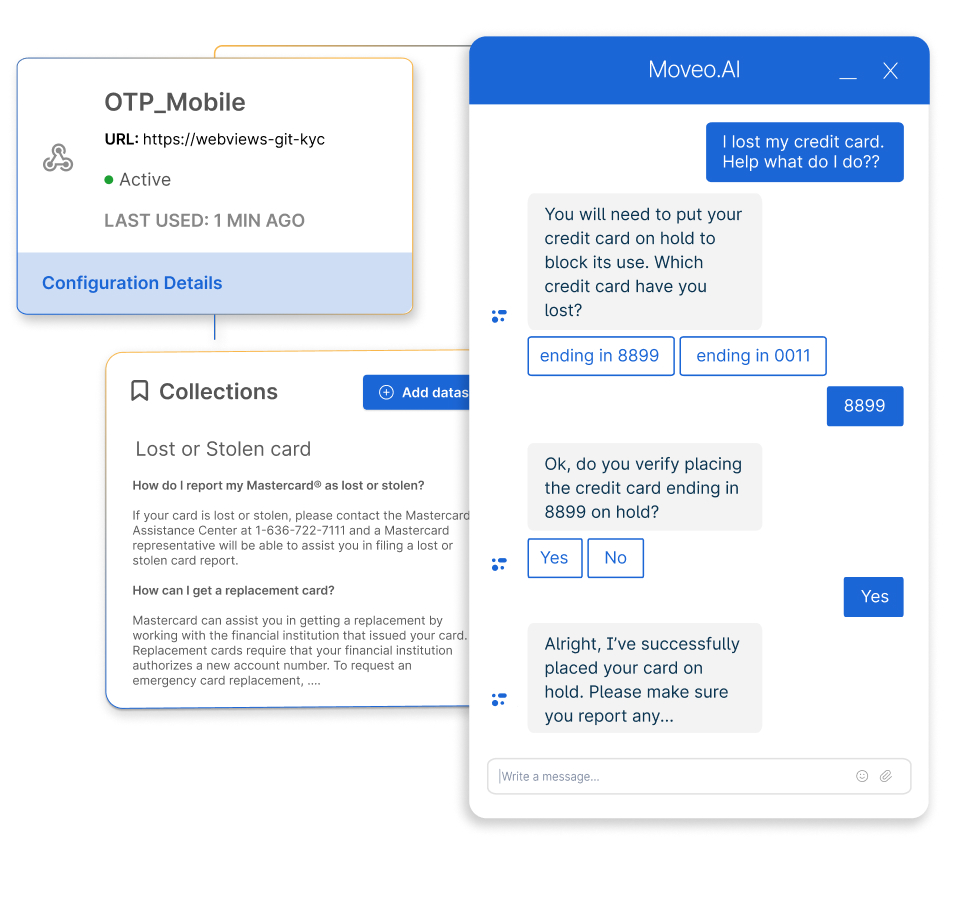

Moveo Can Transform Your CX with GenAI Agents

Moveo’s all-in-one conversational AI platform allows you to quickly create industry-specific GenAI agents and monitor their effectiveness for a range of business processes. We’re trusted by leading banks across the globe — Alpha Bank, Attica Bank, Viva.com, and Edenred — to deliver optimal customer experiences and improve the business bottom line. Learn how we helped Viva scale their operations, reduce inquiry resolution time, and improve overall customer satisfaction. Book a demo today!